The Organic Growth Illusion

How disappearing volume growth will impact companies in unexpected ways 2023

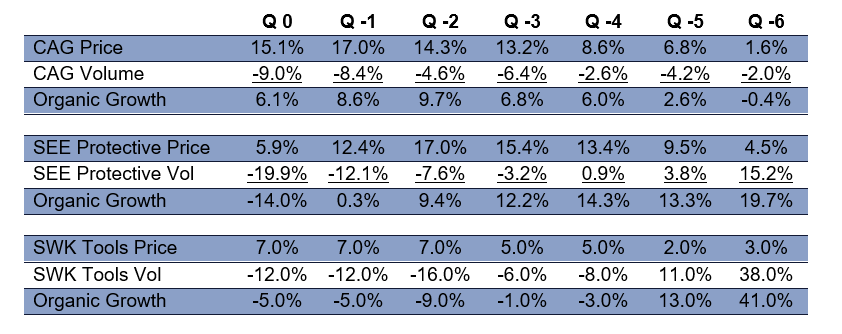

In the back half of 2022, many companies dazzled investors by reporting unexpectedly strong organic sales growth. However, investors must always remember that organic growth is a function of volume growth plus price increase. In many cases, all of the recently reported organic growth has come from companies increasing prices at historic paces. Volume growth, on the other hand, has vanished, yet many are still touting their growth. Here are a few examples from Conagra (CAG), Sealed Air’s (SEE) protective product segment, and Stanley Black & Decker’s (SWK) tools:

There are times when lagging volume growth may not be a glaring problem. Normally, it means a company has changed a core part of its sales. This is what happened at electronic stores when everyone started buying $2,000 computers and fewer $200 CD players. Arguably, movie theaters have seen this too. They are now selling premium tickets for IMAX 3-D, larger & reclining seats, plus serving beer & sushi.

When we look at the companies above, that isn’t the case. Conagra is still selling cans of beans and frozen pot pies. Sealed Air is still selling packaging materials for cell phones and e-commerce shipping bags. Stanley Black & Decker is still selling Craftsman hand tools and cordless drills. In these cases, the manufacturing facilities and delivery trucks already exist. Many of those costs do not change very quickly. Price hikes tend to drop quickly to the income line and profits in dollars and margins tend to rise. The question in the case of the latter three is – what happens if pricing reverses on these companies and how does that happen?

Often higher prices lead to lower unit sales – final customers buy less or switch to another product that is cheaper. That causes orders to drop for the higher priced product.

When orders drop, inventory backs up. If certain raw materials were in short supply and on a 60-day delay, they are suddenly available in 15-20 days. More supply than demand normally lowers prices.

Customers seeing less sell-through may look to cut the levels of inventory they already purchased – this is called destocking.

Customers watch commodity costs declining, they want to offer products at lower prices too and demand lower pricing, and with inventory at several companies backing up, buyers can play suppliers against each other.

In the case of big-box retailers, they may demand more promotional spending. This is normally netted against pricing and represents coupons, paying for premium shelf space, in-store demonstrations, and volume discounts.

When we look at the companies above – all are showing accelerating volume decay already. Commodity costs are down in many areas and others are showing much lower inflation rates. They are still seeing inventory DSIs rise:

Conagra’s inventory is still rising 15-20 days y/y.

Sealed Air is having the same 20 days increase y/y and is seeing some customers destocking inventory they already bought.

Stanley Black & Decker’s normal DSI is 85-100. It has cut production so it’s not replacing the inventory it does sell, and still is at 165 days.

High inventories also bring other future problems amid falling volumes

They were acquired when commodity prices were higher – so as they are expensed, they may pressure margins more.

Falling volumes also mean it takes longer to work down high inventories.

Inventory ties up cash, so it’s tough to sit and hold it for long.

When a company cuts production like SWK is doing, it loses operating leverage. Labor, transportation, depreciation, and maintenance are being spread over fewer units. Thus, future inventories cost more and keep pressure on margins. CAG pointed to pressure from less operating leverage last quarter.

Already SWK gross margins are falling from over 30% to under 20%. CAG’s operating margins are flat-to-down from pre-Covid even with double-digit pricing gains.

SEE still has pricing helping margins overall. But it also has commodity price contracts with its buyers where it can reset pricing when commodities are increasing in value but that pricing reverses when commodities decline.

We believe several inventory and production issues point to weaker pricing gains going forward. We probably shouldn’t ignore the level of price increases already taken setting up some tough comps as those prior price hikes anniversary. When we look at these companies, there may be other reasons why pricing gains may slow or reverse:

CAG is still touting that it is spending less on promotions – that is helping pricing. Competitors are boosting promotions and customers are expecting them. Companies like Walmart and Kroger have said that they expect their suppliers to help them lower prices to the consumer. Had last quarter’s pricing gain been only 14.1% instead of 15.1% - It would have reduced CAG’s operating margin by 80bp and EPS by 5 cents. The company already claimed to beat forecasts by 12 cents but only boosted midpoint guidance by 7 cents. It also guided to inflation at 5% next quarter vs. 8% and 11% the prior two quarters.

SEE just reported the lowest net pricing gain in some time of only $25 million last quarter. In the quarters before that SEE reported taking net pricing gains in excess of inflation of $71, $56, and $68 million. It already has customers destocking and its commodity pass-through deals are normally +/- $10-$20 million and are supposed to net to zero over time. That means SEE could see several quarters of negative year-over-year pricing lagging cost. We noticed that SEE’s price-over-cost situation has added a cumulative excess pricing of over $300 million in the last several quarters. Every $10 million in excess pricing is worth 5 cents in EPS for SEE.

SWK is already taking drastic action to reduce inventories by cutting production. It is reducing the number of SKUs as well, which could mean marking down the prices for any inventory that is discontinued. Its customers are still buying less too, which may pressure selling prices more as it wants to reduce inventories. Much of the bomb has already gone off at SWK – while the others appear to be closer to the edge. SWK’s forecast coming into 2022 was EPS of $12+, but it earned $4.62. SWK is forecasting that much of 2023 will be lost simply correcting the excesses of 2022. Another precursor to come is SWK’s debt looks more onerous because EBITDA and margins are already falling so much. The others have debt also, but the higher pricing is still helping EBITDA.

If you are interested in our institutional research service, please contact behindthenumbers@btnresearch.com.

You can follow us on Twitter here

Disclosure:

This article is intended for educational purposes and is not investment advice.

Behind the Numbers, LLC is an independent research firm structured to provide analytical research to the financial community. Behind the Numbers, LLC is not rendering investment advice based on investment portfolios and is not registered as an investment adviser in any jurisdiction. All research is based on fundamental analysis using publicly available information including SEC filed documents, company presentations, annual reports, earnings call transcripts, as well as those of competitors, customers, and suppliers. Other information sources include mass market and industry news resources. These sources are believed to be reliable, but no representation is made that they are accurate or complete, or that errors, if discovered, will be corrected. Behind the Numbers, LLC does not use company sources beyond what they have publicly written or discussed in presentations or media interviews. Behind the Numbers does not use or subscribe to expert networks. All employees are aware of this policy and adhere to it.

The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. Other CPAs, unaffiliated with Mr. Middleswart, may or may not have audited the financial statements. The authors also have not conducted a thorough "review" of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing contained herein shall be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a "BUY" or "SELL" recommendation. Rather, this research is intended to identify issues that investors should be aware of for them to assess their own opinion of positive or negative potential.

Behind the Numbers, LLC, its employees, its affiliated entities, and the accounts managed by them may have a position in, and from time-to-time purchase or sell any of the securities mentioned in this report. Initial positions will not be taken by any of the aforementioned parties until after the report is distributed to clients, unless otherwise disclosed. It is possible that a position could be held by Behind the Numbers, LLC, its employees, its affiliated entities, and the accounts managed by them for stocks that are mentioned in an update, or a Peek Behind the Numbers article.