Teradata: A Value Screen Mirage? (TDC)

10x earnings looks cheap, but accounting concerns suggest otherwise

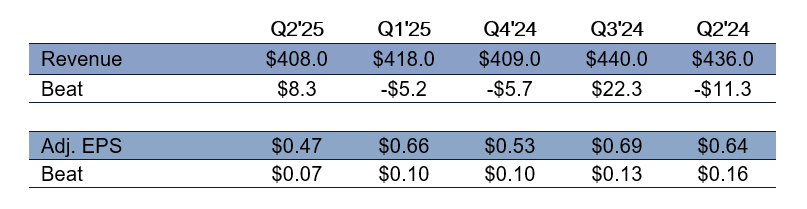

Teradata (TDC) has struggled with stagnant to declining sales for years. Despite this backdrop—and earnings that continue to trend lower—the company has consistently beaten consensus forecasts by wide margins. Management has also been active in repurchasing shares, a strategy that typically wins favor with investors. These factors have sparked debate over whether TDC might be setting up for a turnaround.

Our view, however, is more cautious. After delivering adjusted EPS of $2.42 in 2024, TDC guided to a weaker $2.12–$2.25 for 2025, despite the boost from a reduced share count. Year-to-date, the company has exceeded estimates by $0.17, but management has only nudged the lower bound of guidance up by $0.03. The modest move suggests limited confidence in accelerating growth. In fact, we see several signs pointing to prolonged sales pressure. While TDC's valuation near 10x EPS may appear attractive on screens, accounting-related red flags raise questions about the quality of reported earnings and cash flow. Investors should carefully weigh these risks before considering the stock.

Let's get behind TDC's numbers: