“Show me the money.”

- Jerry McGuire

Starting at the top of the income statement, everyone will recognize “sales” or “revenue” as a basic concept. It is simply the value of the goods or services that the company supplies to its customers. However, what many may lose sight of is the fact that even this seemingly simple number is based on many management assumptions, and minor changes in those assumptions can materially impact what the company reports on the top line. Therefore, sales should be viewed in conjunction with other financial statement items to determine their reliability. In this article, we will spend some time looking at accounts receivable.

Most companies are not paid in cash immediately at the time of the sale. When sales are made, the company recognizes that it has delivered the product or service and billed the customer. At this point, the customer essentially has a debt to pay the company the agreed-upon transaction price and the company recognizes that debt in an asset account on the balance sheet known as accounts receivable . Receivables are widely expected to be short-term in nature. (There are exceptions if the receivables are tied to a large, multi-year project such as building a power plant, a jet fighter, or a new highway.)

Since sales drive the creation of receivables, we need a ratio that captures the movement of both. The preferred measure that should be reviewed in comparing sales and receivables is known as Days Sales Outstanding or DSO. While there are several versions, we prefer the following formula:

This formula gives us the average number of days it took the company to collect a receivable from a customer during the period being reviewed. Some prefer to look at the ratio on a twelve-month basis in which case they take the last year’s sales divided by the average of the beginning and ending receivables balances and multiply that by 365 days. There is nothing wrong with this, but we like to calculate the ratio quarterly and track over several quarters to better highlight the turning points in the DSO trend.

What you want to see is a ratio that stays fairly constant thus indicating that the company is being paid in a timely manner. There may also be some seasonality. For example, a company that does a large percentage of business around Christmas sees customers order more merchandise in the fourth quarter and pay for it after the holiday season. A good example of a highly seasonal company is Pool Corp (POOL) which supplies products used for swimming pools and sprinkler systems. Here are its DSOs for the last four years:

POOL’s first quarter ends in March and the company starts to see sales expand as retail customers stock up for later spring and early summer. Thus, DSOs are much higher at the end of the first quarter than other quarters. That seasonality should be expected. Therefore, we should compare the 1Q 2021 figure to the 1Q 2020 figure. From that perspective, POOL has seen its collection times fall a couple of days of late.

What Does a Rising DSO Number Indicate?

Rising DSOs do not always indicate an underlying problem. For example, when a company makes a large acquisition in the latter part of a quarter it will result in all of the acquired company’s receivables hitting the balance sheet at once while the income statement may only include a couple of weeks of the acquired company’s sales. This artificially inflates the numerator relative to the denominator in our DSO formula. Likewise, a company that is experiencing rapidly accelerating sales growth will by nature see an upward trend in receivables as sales will be skewed to the end of the period being examined and the receivables associated with those sales will not have time to be collected before the period closes. However, a trend of rising DSOs always warrants close attention as it can be a sign of a couple of serious problems. The problem we will examine today is that of a growing trend of customers not paying.

It is important to remember that receivables are not cash. When they grow, it can also be a sign that the company is not being paid by its customers. For example, we remember a company called Fleming that was a distributor and supplier to many independent grocery stores and other retailers. At one point, it beat out its rival to become the sole supplier to a troubled chain called K-Mart. Fleming stock jumped on the news on expectations of a huge boost to business. About 9 months later, as K-Mart was going bankrupt, much of that new revenue booked by Fleming turned out to be unpaid receivables on Fleming’s balance sheet. The bulls were not as excited about that new contract which shrank as K-Mart closed stores. It became clear that much of the revenue that Fleming had already booked would never actually turn into cash.

The Tale of Healthcare Services Group

We want to highlight the experience of Healthcare Services Group (HCSG) as another instance where DSOs were flashing a clear warning sign of customer credit problems. We want to emphasize that this article is an examination of trends at Healthcare Services Group from the 2017-2019 timeframe and should not be taken as an indication that these trends are still relevant to the company’s performance today.

Healthcare Services Group provides cleaning, laundry, and cafeteria operations for senior living centers. The stock was cheered as a growth machine due to the “aging of America” theme that was expected to ensure more business for decades to come. However, there are several often overlooked problems with the retirement home business. For starters, they have very high fixed costs and require trained staff such as nurses to be available at all times. There are rising regulatory requirements, not to mention the difficulties of being paid by Medicare and Medicaid. Making meals for 25 residents or 15 requires the same wages paid to the cooks despite the latter situation generating less revenue. To top it off, senior living centers were also dealing with many potential residents delaying entry until their families could no longer care for them. Thus, occupancy was lower than expected and when the new residents did arrive, they were sicker and required more care resulting in higher than expected expenses. The profit margins and credit quality for HCSG’s customer base were getting worse.

The story HCSG was telling didn’t match up with the one that receivables and DSOs were illustrating. HCSG repeatedly noted that its customers pay their bills within one month. Also, the contracts it had with customers lasted for only one year. Yet HCSG was extending payment terms in some cases longer than one-year. We would have expected a DSO figure of 15-25 days. We saw this instead:

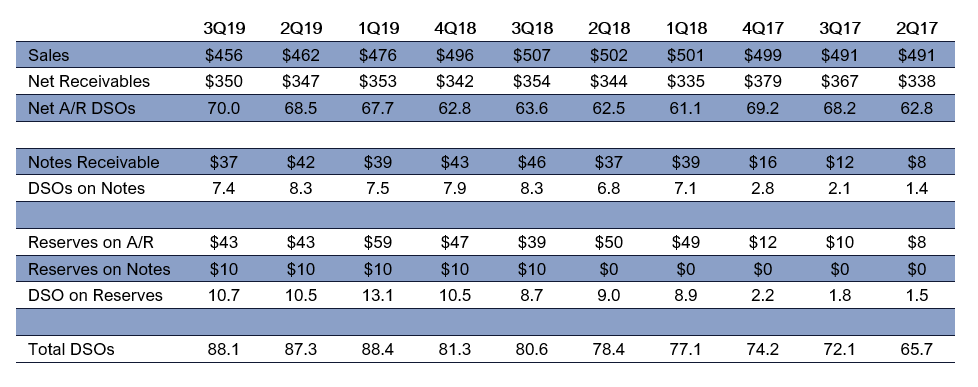

Going back 18 years, the lowest figure we saw for DSOs was 2012’s 48 days. This just didn’t pass the smell test. The DSOs kept rising, and when clients could not pay them, HCSG started converting the accounts receivable into “long-term notes receivable.” It also started to take larger and larger reserves against these receivables. This reduced the reported net receivables balance which made DSOs look better. But look at the total figures:

There were quarters when it appeared DSOs declined. However, HCSG was simply moving receivables into long-term notes receivable that had terms longer than one-year which can be clearly seen in 1Q18 and 1Q19. That is despite the fact that the contract with the facility was less than one year. It was also adding much more to the bad debt reserves like in 1Q18 and 3Q18 and 1Q19. This reached the point where HCSG had 13 days of sales listed as potential bad debt. If we adjust for this movement, it is clear that DSOs did nothing but continue to grow and reached essentially a full quarter of sales at 88 days – up more 22 days in two years. During 2017-3Q19, the company also wrote off $43 million of impaired receivables which is another 8.5 days of sales.

During this time, HCSG was saying on multiple earnings calls that it was tightening up credit payment terms and moving customers to even 7-day and 14-day payment terms:

In 3Q18, management said one-third of customers were on a payment schedule of less than 30-days.

In 4Q18, management said 40% of customers were on a faster payment plan with many on 7-14 days.

Also in 4Q18, one of the more troubled customers had the food contract changed – the customer would buy the food and supplies and HCSG would only supply the labor. Thus, its sales and future receivables from this customer would decline by about $20 million per quarter.

In 1Q19, HCSG said that 55% of the customers were now paying more quickly with many on 7-14 day terms.

All of that should have pushed DSOs down, but they continued to increase even on declining sales. If one ignored the receivables put into bad debt allowances and the ones moved to long-term notes and assumed that 55% of customers were paying faster than 30 days with many on 7-14 day terms, then the DSO on just net receivables should have been 30 days or below. However, they still rose from the low 60s to 70 days.

The reality was that a key component of the company’s business model was extending credit to customers in a cash squeeze. HCSG would take over the customer’s current employees who were doing cleaning, laundry, and foodservice, and remove that expense from the retirement homes. It would let the customers delay payments for 30-60 days, giving them some immediate cash flow. It also capped the cost for the retirement home. If cleaning/laundry/food employees had to work overtime, it was HCSG’s problem.

From 2Q17 to 3Q19, HCSG’s stock declined from $54 to $22. That includes three quarters when the bad debt expense and other credit issues were impacting results and causing the stock to decline rapidly. During 2020, the company wrote off another $36 million of impaired receivables. Today, it still does lower revenue than it was reporting in 2017 and 2018 (although Covid admittedly accounts for some of that.) We contend this was all predictable as DSOs gave significant clues to investors who dug “behind the numbers” that HCSG’s revenue was low-quality and much of it would not be collected in cash.

We will examine another significant problem uncovered by rising DSOs in our next installment of Peek Behind the Numbers.

To subscribe to Peek Behind the Numbers for free:

If you have friends or colleagues who would be interested: