Healthcare Services Group (HCSG)- Has Anything Really Changed?

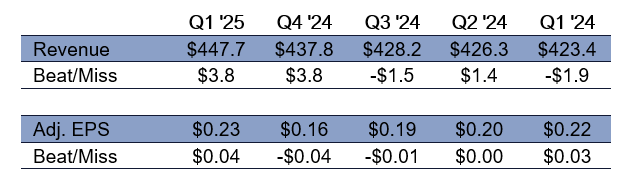

HCSG's Q1 beat driven by one-timers, not fundamentals

We first began covering Healthcare Services Group (HCSG) in 2018, when the stock was trading in the $50 range. At the time, we were concerned about the company’s aggressive extension of receivables in an apparent effort to delay write-offs. This ultimately caught up with the company and led to a sharp decline in its share price. We hadn’t revisited the name until recently when stronger-than-expected earnings brought it back into the headlines. With the market cap now back at $1 billion, we felt it was time for a fresh look.

We found that HCSG is largely the same company it had been: no growth, low margin, and often not getting paid by its customers. It also has three accounting-related moving parts that move earnings more than actual core operations: Bad Debt, Insurance Accruals, and the Deferred Compensation Plan.

Let’s take a look behind the numbers: