DNOW’s (DNOW)- Q1 More Optical than Operational

More unsustainable benefits may explain uninspiring guidance

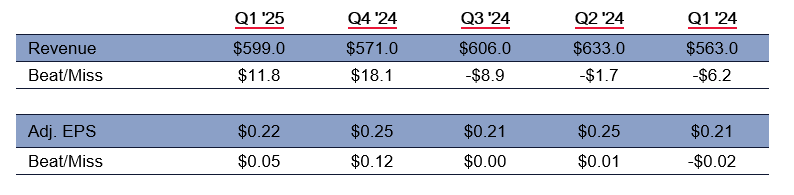

We last discussed DNOW in our February report, in which we covered multiple unusual items that benefitted results. The company beat estimates in Q1:

However, It only maintained guidance for the year and expects revenue to be flat to up mid-single-digits from the $599 million of Q1, which sounds like flat to down y/y. Meanwhile, the one-time benefits continued while multiple other expense items also came in below guidance to help the company beat EPS targets.

We get behind DNOW’s numbers below: